Selling Gold in Dubai

the gold market. Thanks to its smart tax policies, secure infrastructure, and transparent competitive market, the city attracts not only gold buyers but also sellers—from professional traders to travelers and tourists looking to sell their personal gold items.

However, selling gold in Dubai isn’t as simple as walking into a store. From preparing your gold and understanding its true value to choosing the right selling location and receiving your payment safely, each step requires attention, knowledge of regulations, and careful consideration of legal and security aspects.

In this guide, we walk you through the complete process of selling gold in Dubai in clear and practical terms—from identifying gold types and pricing methods to exploring reliable markets, online platforms, customs requirements for tourists, and tax regulations. Whether you’re selling gold for profit or simply converting it into secure cash, this article offers a step-by-step, trustworthy roadmap.

Step One: Preparing to Sell Your Gold

1. Assessing Your Gold

- Type of gold: Jewelry, bullion, coins, or second-hand gold

- Purity: 18K, 21K, or 24K

- Physical condition: Scratches, damage, gemstones, or surface cleanliness

Note: Stones are usually excluded from the price unless they are certified precious gems.

2. Required Documents

- Purchase invoice (if available)

- Valid passport or ID (for foreigners or tourists)

- Gold certificate or purity documentation (in specific cases)

Selling gold without an invoice may result in a lower price or might only be accepted by select dealers.

Step Two: Understanding Pricing and Fees

3. How Gold is Priced in Dubai

Formula:

Weight × Live Market Rate per Gram × Purity

Deductions:

- Refining or melting charges (for second-hand gold)

- Making charges are excluded for used jewelry

In Dubai, making charges typically range between 7% and 25% of the pure gold price—depending on design complexity, seller brand, and decorative features.

Gemstones are usually excluded from the gold’s weight and valued separately or treated as scrap.

Fees may include:

- Buyer/seller commission (2% to 5%)

- Valuation or certification fees at some locations

- For online transactions: shipping or insurance fees may apply

Step Three: Choosing the Right Place to Sell

4. Markets and Shops

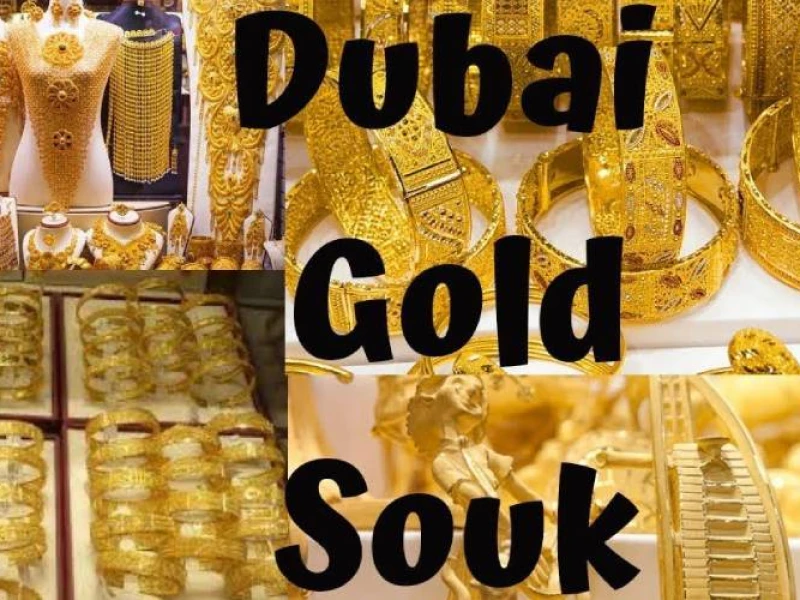

Dubai Gold Souk

- One of the safest and most competitive gold trading hubs

- Dozens of reputable dealers

- Price comparisons and bargaining are common

- Location: Deira – Al Khail Street

- Opening Hours:

Saturday to Thursday: 9:30 AM – 9:30 PM

Friday: 4:00 PM – 9:30 PM

Luxury Shopping Malls

(e.g., Dubai Mall, Mall of the Emirates)

- Secure and formal environment

- Renowned international jewelry brands

- Ideal for selling branded or ornamental gold jewelry

Independent Shops

- Areas like Karama, Bur Dubai, and Wafi

- Often offer better prices due to lower operating costs

- Suitable for second-hand or non-branded gold

5. Online Platforms and Mobile Apps

Websites & Online Marketplaces:

- GoldTrade.ae

- Dubai Gold Market

Mobile Apps (Android/iOS):

- Equiti Gold

- O Gold

- Joyalukkas Mobile App

These platforms offer:

- Live gold prices

- Price comparison among buyers

- Secure transactions

- Payment options via bank transfer or cash

Step Four: Receiving Payment and Fund Transfers

6. Common Payment Methods:

- Cash (at the store)

- Local debit card (AED)

- Bank transfer (within the UAE)

- International transfer (subject to the tax laws and banking restrictions of the recipient’s country)

Most official shops issue a formal receipt.

For amounts over AED 50,000, enhanced identity verification may be required.

Legal and Regulatory Information for Selling Gold in Dubai

7. Rules and Regulations:

- Sellers are required to record your identity.

- Large-volume sales may be reviewed by the Economic Department or Customs.

- For tourists, a valid passport is usually sufficient.

- Under UAE law, a valid ID and proof of ownership (authentic gold) are required.

- Selling stolen or unverified gold is a criminal offense and may lead to legal prosecution.

Timing Matters:

- Global gold price surges are the best moments to sell.

- High tourist seasons (e.g., winter, Dubai Shopping Festival) may increase demand and result in better offers.

How to Determine the Value of Your Gold Before Selling

- Check the weight: Gold is priced per gram.

- Know the purity: 18K is less valuable than 24K.

- Review live market prices via trusted websites or apps.

Security Tips and Fraud Prevention

8. Ways to Avoid Scams or Loss:

- Avoid unlicensed or unknown shops.

- Always request an official receipt.

- Don’t sell borrowed or rented gold.

- Be vigilant in crowded markets—watch out for theft and scams.

- For online sales, use platforms with verified trust seals.

- Some buyers may offer lowball prices or misrepresent purity—ensure official testing tools are used on-site.

Special Guide for Tourists Selling Gold in Dubai

Selling gold as a tourist is allowed.

Required document: Passport

Payment options: Cash or card

1. Check Your Gold Quantity and Value

- Personal jewelry (rings, necklaces, etc.) is generally exempt from declaration if:

Up to ~40g for women

Up to ~20g for men - If you carry more or are transporting bullion, coins, or raw gold, you must declare it.

- If the total value of gold and other cash assets exceeds AED 60,000–100,000, you must declare it to customs.

2. How to Declare Gold at Dubai Customs

- Declare in person upon arrival

- Use the Red Channel at the airport

- Inform the customs officer and complete the declaration form

- Provide:

Passport

Purchase invoice or certificate (especially for bars or coins)

Estimated value in AED or USD

You may convert currencies at Dubai’s top exchange houses

3. Customs Duties and VAT (if applicable)

- Personal jewelry within limit: usually no duty

- Raw gold or high-value items: 5% VAT may apply

- Failure to declare can lead to fines or confiscation

4. Declaring Gold on Exit

- If exiting UAE with significant gold amounts (especially bars or large quantities), you must declare again.

- Carry your invoice and purity certificate to avoid issues in your destination country.

Additional Notes

Selling Without an Invoice:

- Only certain shops may accept it

- Lower price offers are likely

- Authenticity is assessed through hallmark and purity testing

Professional Safety Recommendations:

- Use insured transport for high-value gold

- Get professional appraisals before selling

- Bring a trusted companion if possible

Why Selling Gold in Dubai Has Advantages Over Other Countries

- 0% Tax: No VAT on second-hand gold sales means higher profit margins

- High Demand: Dubai's status as a trading hub ensures a liquid market

- Competitive Prices: Multiple buyers and shops mean you can compare offers and get the best deal

Conclusion

Understanding the key aspects of buying and selling gold in Dubai will help you make smart, secure decisions. Thanks to its tax-free status, transparent market, and global reputation, Dubai often offers lower gold prices and better selling conditions than many other countries.

The best time to buy gold is during global price drops or events like the Dubai Shopping Festival. When selling, focus on purity, weight, and work only with reputable shops in places like the Gold Souk or high-end malls to ensure authenticity and fair deals.

FAQs: Selling Gold in Dubai

1. Do I need a quality certificate to sell gold in Dubai?

Yes, having a certificate or purchase invoice can help you get a better price.

2. When is the best time to sell gold in Dubai?

When global gold prices are rising or during high-tourism seasons like winter.

3. Is bargaining common when selling gold in Dubai?

Yes, negotiation is normal and can help you secure a better deal.

Reviews

Please submit your comment.

It will be displayed after the approval of admins.

To do this, please login first

No comment submitted yet